Disclosure: I’m not a tax expert and this article is for informational purposes only. I do not provide tax, legal or accounting advice, so you should always do your own research and consult with your tax advisor.

It is important to choose a suitable form of your business when you are an Internet publisher, an online freelancer, or a Youtuber. If you work for your own, the two most common legal entities are sole proprietorship and single-member S-Corp. There are some benefits of forming an S-Corp such as limited liability or savings on self-employment taxes. However, changing business type to S-Corp requires a lot more paperworks and complicates our tax returns, so it is not the best option for everyone. Moreover, many states are charging corporate excise every year, so S-Corp might not be as beneficial as many people stated.

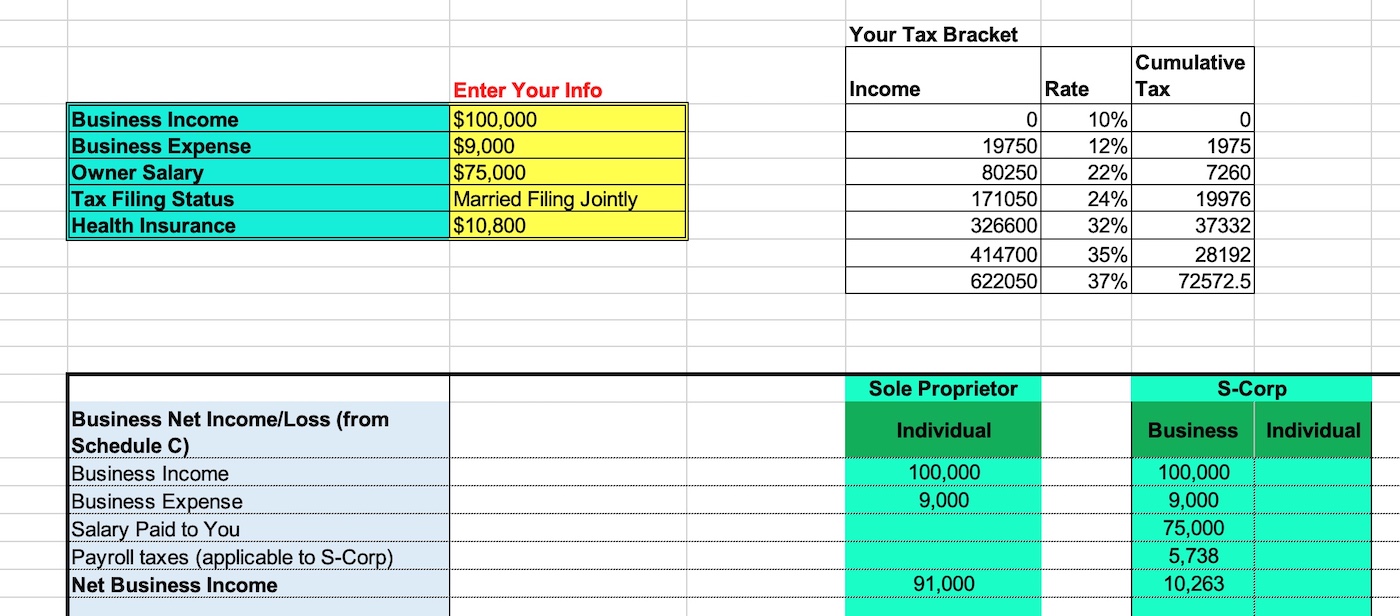

In many cases, you will have to pay more money in taxes and expenses in the end with an S-Corp. Therefore, you should do the research carefully before deciding to switch from sole proprietorship to S-Corp. Let’s take an example of Oliver who is a Youtuber earning $100,000 from his channel, his business expenses are $9,000 in total, he is filing a joint return with his wife, and he pays $10,800 for his family’s health insurance. We are assuming his wife is staying home, he doesn’t take any distribution out of his business, and he has no other income from investments. If he is a sole proprietor, he will have to pay self-employment tax (Social Security and Medicare tax) on the whole net income.

If he forms a single-member S-Corp, he is treated as an employee and must be paid an reasonable salary. Average salary for an Internet publisher ranges from $60,000 to $90,000, so he chooses the average salary of $75,000. The salary is subject to the Social Security and Medicare tax, similar to a sole proprietor. However, the net income of his business reduces dramatically to just over $10,000 after paying the salary for himself.

Both a sole proprietor and an S-Corp can claim the 20% qualified business income deduction until at least 2025. As a sole proprietor, the business’ net income is much higher, so the deduction is much larger. Besides, he can also claim half of self-employment tax and health insurance.

In the end, Oliver just needs to pay $16,155 in tax as a sole proprietor but if he forms an S-Corp, he will have to pay $18,089 in total. If we take into account expenses of an S-Corp, the total tax would be at least $19,000. Therefore, being a simple sole proprietor actually saves Oliver a lot of tax money in this case.

So, choosing between sole proprietorship and S-Corp is not an easy decision because it depends largely on your earnings and salary. You will need to do your own calculations to figure out which business entity has more tax savings for you. I’ve made an Excel spreadsheet for myself to make the work easier. You will just need to enter your business income, expenses, salary, choose filing status, then the spreadsheet will do all the calculations and you can check out the total taxes at the end. You can get the Excel spreadsheet here for $25 (I will process your order within 24 hours). Make sure to consult with your tax advisor because this is a complex issue. I’ve updated the spreadsheet for tax year 2022; The due date for filing tax returns and making payments is April 18, 2023.

Disclosure: We might earn commission from qualifying purchases. The commission help keep the rest of my content free, so thank you!